Two weeks ago thousands of Philadelphia public school students walked out of their classrooms to head to City Hall and to the school district headquarters with one demand: more funding for education. The budget deficits and poor priorities of city government have caused the city to close 23 schools with more cuts coming to music, art, sports, after school activities, and community centers, among a host of other public service cuts in the coming years. When asked “why?” the local and state government always cry “austerity!” and “cutbacks!” Why? We know where the money is; We just need to go get it back.

Between 2003 and 2009, 107 school districts and 86 local governments in the Commonwealth of Pennsylvania entered into interest rate swap deals with some of the power house banks on Wall Street: Wells Fargo (then Wachovia), Morgan Stanley, and Goldman Sachs, among others. All together those districts and governments tied up $14.9 billion dollars in the swaps. Philadelphia was one of those school districts. During the life of those loans they lost $331 million in interest and cancellation fees. That’s on top of the net loss of around $71 million that they lost over the life of the swaps in fees and services.

Last year the Philadelphia school system had a $629 million dollar budget deficit. That deficit has caused schools to close, teachers to be laid off, and cultural programs being removed from the remaining schools’ curricula. In 2008 the big banks received $700 billion (with essentially a $3.5 trillion buffer in addition loans being offered) in rescue funds from the federal government while our city was losing tens of millions in interest to the banks. While our schools were starved the fat cats were feasting on our losses. In the third quarter of 2012 Wells Fargo alone posted $4.9 billion in profits. Where did that money come from? It came from starving schools systems and city governments who are now faced with a choice: default on their debt or cut essential services. Goldman Sachs CEO Lloyd Blankfein earned $21 million last year. Where did that money come from? In part, from the Philadelphia school district.

These huge megabanks were not born in Philadelphia (indeed, they were never born at all). They weren’t even conceived here. Wells Fargo is a West Coast bank. Bank of America has its base of operations in North Carolina (for low corporate tax rates, mind you). These banks are more than strangers. They are shady strangers with a gun protruding from their suit pocket.

If they are going to operate their global mob operation within our city limits then the least they can do is pay for it.

When asked “why?” tell them it was for the single mother who works two jobs whose son is on the street because there was no funding for the community center. Tell them it’s for the next Mozart who just had her clarinet taken from her because there was no funding for instruments. Tell them its for the young man who could finally make the Sixers great again but can’t play because he has to work a job and go to an underfunded school because he has to take care of his sister because his mother can’t afford her medicine and their groceries. Tell them it is for the People.

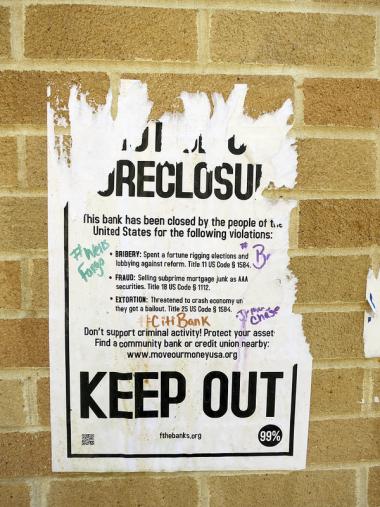

When will these vampires have enough of sucking the lifeblood out of our families and communities with their racist predatory lending, unjust forecloses, and gambling on Wall Street? How long is it going to take our leaders to recognize the connections between austerity-minded politicians, the greed of corporate lobbyists, and the satanic temple that is the banking industry? And when are we going to get our retribution?

The city should start by taking every public dollar out of Wells Fargo as councilman Kenney’s has proposed. Then they should demand their money back from the cancellation fees and, if they are brave, the damages from the manipulation of LIBOR rates and subsequent losses incurred on interest payments. Then they should pass a Robin Hood tax on big banks: put a price on every transaction that banks enter into with the city and charge them an occupancy tax.

The connection between the greed of the big banks, our current budgetary plight, and the educational crisis is obvious. The question is what are we going to do about it.